Harvest tax losses like a pro

Connect your brokerage accounts and get notified about unrealized capital losses that could be harvested.

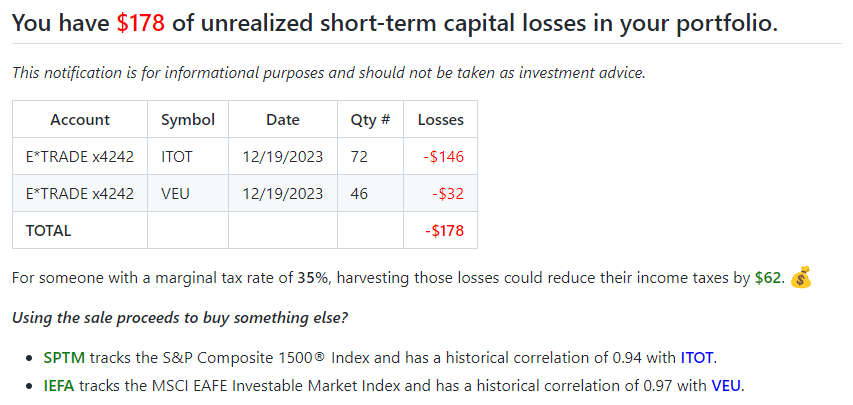

Get notified...

Tax loss harvesting used to be time consuming and error prone

Watching markets, tracking tax lots, avoiding wash sales... Without Harvest IY, it can feel like a full-time job:

🧐📈

Watch the market for dips

🤨📅

Check your positions over and over

😒📋

Track dates to avoid wash sales

😔

Give up

Pricing

Save time and never miss another tax loss!

Free

$0

- ✅Detect tax-loss harvesting opportunities

- ⬜Coming Soon: Get list of replacement securities

- ✅Unlimited notifications

- ❌No connected accounts

- ⚠️Manual lot entry required

Starter

$30

$19

/month

- ✅Detect tax-loss harvesting opportunities

- ⬜Coming Soon: Get list of replacement securities

- ✅Unlimited notifications

- ✅Connect unlimited accounts

- ⚠️Combined balance of connected accounts limited to $300k

POPULAR

Unlimited

$50

$39

/month

- ✅Detect tax-loss harvesting opportunities

- ⬜Coming Soon: Get list of replacement securities

- ✅Unlimited notifications

- ✅Connect unlimited accounts

- ✅No balance limits

FAQ

Frequently Asked Questions

- Tax-loss harvesting is when an investor sells a security for a loss in order to reduce their income taxes. You can read more about this strategy on Investopedia: Tax-Loss Harvesting.Always consult a tax professional to help you decide whether a particular tax strategy may be right for you!

- Tax-loss harvesting with replacement is when an investor sells a security for a loss and uses the proceeds to buy another security in order to maintain a similar long position. Typically, an investor will select a replacement security whose returns are expected to be similar to the original security that was sold. That way, the investor reaps the tax benefits of tax-loss harvesting while maintaining a long position in the market.For example, if an investor has losses on a position lot in ITOT (an ETF that tracks the S&P Total Market Index), they can sell the ITOT lot and use the proceeds to buy SPTM (an ETF that tracks the S&P Composite 1500 Index). SPTM has a historical correlation of 0.94 with ITOT.The realized losses from the ITOT sale can reduce the investor's income taxes, but they still maintain a long position in a broad US equity ETF (SPTM).Always consult an investment professional to help you decide whether a particular strategy may be right for you!

- It's pretty simple!

- ● Sign up for Harvest IY and connect your brokerage accounts.

- ● We scan your accounts every day for any unrealized capital losses on positions held longer than 30 days.

- ● If we find any, we send you an email with the details.

- ✅ AJ Bell

- ✅ Alpaca

- ✅ Binance

- ✅ Bux

- ✅ Chase

- ✅ Coinbase

- ✅ CommSec

- ✅ DEGIRO

- ✅ E*TRADE

- ✅ Empower

- ✅ Fidelity

- ✅ Interactive Brokers

- ✅ Public

- ✅ Questrade

- ✅ Robinhood

- ✅ Schwab

- ✅ Stake Australia

- ✅ TD Direct Investing

- ✅ TradeStation

- ✅ Tradier

- ✅ Trading212

- ✅ tastytrade

- ✅ Upstox

- ✅ Vanguard US

- ✅ Wealthsimple

- ✅ Webull US

- ✅ Wells Fargo

- ✅ Zerodha

- ⬜ Want to connect another financial institution? Contact us

- ● We store the minimum data necessary to identify tax loss harvesting opportunities in your portfolio and notify you about them.

- ● We also store the minimum data necessary to determine your billing tier such as the account balance for each connected account.

- ● Your data is stored securely in our cloud database.

- ● Whenever practical, we purge data that is no longer needed. i.e. When it will not interfere with the proper functioning of the application.

- ● We do not share your data with anyone else.

- ● Questions or concerns about our data practices? Contact us

- Short answer: No. Harvest IY is a tool that provides information about your portfolio. We are not a registered investment advisor (RIA).Long answer: According to the Investment Advisers Act of 1940, an "investment advisor" is any firm that:

- ● for compensation;

- ● is engaged in the business of;

- ● providing advice to others or issuing reports or analyses regarding securities.

Harvest IY is not considered an investment advisor because:- ● We send our users informational notifications, not advice.

- ● These notifications are provided for free (i.e. no compensation).

- ● We only receive compensation for other features such as the number of connected accounts being scanned and their combined balance.

- Harvest It Yourself!Because we help investors who want to DIY their tax-loss harvesting.

- Yes! You can request a refund within 7 days of your purchase. Reach out by email.

- Cool, contact us by email

Harvest losses, boost your returns, save time

Never miss another opportunity to harvest tax losses...